In the rapidly evolving landscape of logistics, private fleets are experiencing a remarkable transformation, characterized by faster growth, competitive driver pay, and innovative equipment strategies. In fact, private fleets now account for 75% of their companies’ outbound freight movements, marking a notable increase from previous years. With average annual driver compensation soaring to a record $91,081—representing a commitment to attract and retain skilled professionals—companies are recognizing that their drivers are their most valuable asset.

According to Tom Moore, experts emphasize that “private fleets are capturing enhanced control over the supply chain.”

Furthermore, as fleets shift towards younger equipment and adopt advanced strategies, they are increasingly reducing average annual mileage per heavy-duty unit to an all-time low of 80,400 miles. These trends not only underscore a proactive approach to efficiency but also reflect the industry’s dedication to safety, with DOT recordable accident rates reported at an impressive 0.49 crashes per million miles. In this article, we will delve deeper into these trends and explore how private fleets are strategically repositioning themselves for future success.

Insights on Average Annual Mileage for Heavy-Duty Units

Recent data indicates a notable decline in the average annual mileage for heavy-duty trucks in the U.S. trucking industry. The average annual mileage per heavy-duty unit dropped to 80,400 miles in 2024, marking the lowest figure in the National Private Truck Council’s (NPTC) survey history. This downward trend is attributed to several operational strategies, including the strategic placement of distribution centers closer to customers, which reduces the distance goods need to travel. Tom Moore, executive vice president of the NPTC, noted that this decrease can be partially explained by a higher number of distribution centers and warehouses, leading to fleets driving less.

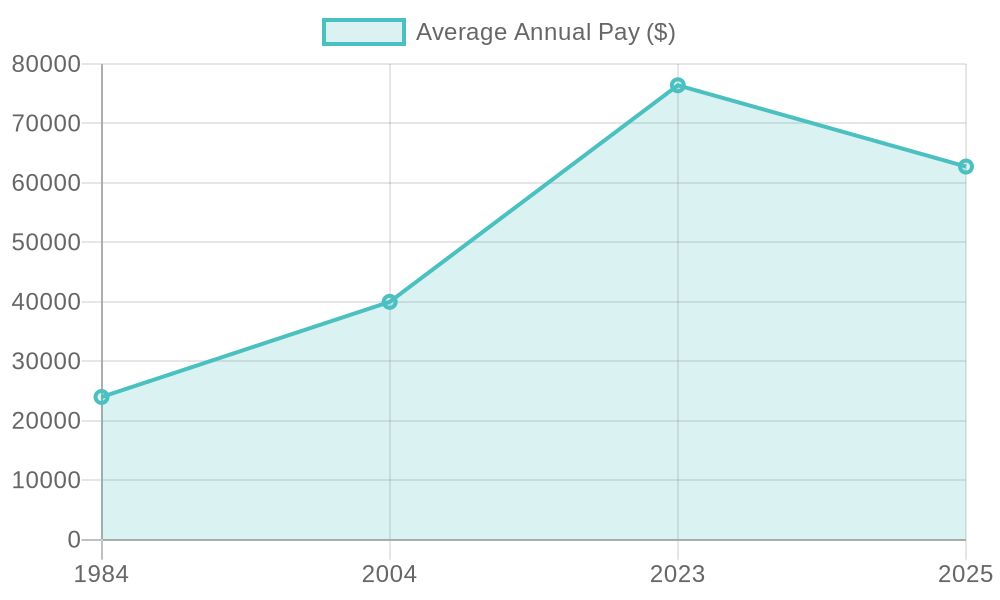

Historically, heavy-duty trucks have experienced fluctuations in annual mileage. In 1982, Class 8 trucks averaged 50,000 miles per year, which increased to 76,500 miles by 2012. More recent statistics from the U.S. Department of Energy show that combination trucks averaged 62,229 miles annually in 2021.

For private fleet operations, the reduction in annual mileage has several implications. It can lead to lower fuel consumption and maintenance costs as vehicles endure less wear and tear. Additionally, shorter routes and reduced time on the road can improve driver retention by allowing for more predictable schedules and increased home time. As these firms optimize their operations, they can allocate resources to enhance driver compensation, now averaging $91,081. This aligns with the industry trend that emphasizes the correlation between a lower mileage capacity and higher driver pay, ultimately enhancing overall job satisfaction.

The NPTC’s report highlighted that driver turnover dropped to 18.4% in 2024, suggesting that these operational changes may positively impact driver satisfaction.

Industry experts emphasize the importance of adapting to these changes. Tom Moore stated, “Private fleets are capturing enhanced control over the supply chain,” indicating a shift towards more efficient and customer-centric operations.

In summary, the decline in average annual mileage for heavy-duty trucks reflects a broader transformation in the trucking industry, with private fleets optimizing operations to enhance efficiency, reduce costs, and now enhance driver satisfaction through increased pay.

The rising average driver pay, now reaching a remarkable $91,081, has been pivotal in enhancing driver retention and reducing turnover rates within the trucking industry. With turnover now sitting at 18.4%, this increase in compensation has not only attracted new talent but also significantly improved job satisfaction among existing drivers. Research indicates that private fleets, often offering competitive wages and better working conditions, have achieved lower turnover rates compared to the industry average. By investing in drivers, companies are fostering a sense of loyalty and stability within their workforce, ultimately reflecting the correlation between retaining skilled drivers and competitive pay.

Analyzing Equipment Strategies of Private Fleets

In the logistics sector, private fleets are using strategic approaches. They focus on keeping their equipment newer and following faster maintenance practices. Having younger fleets helps improve efficiency and lowers costs linked to older equipment. Data shows that Class 8 power units are traded in after an average of just 568,000 miles. This indicates a strategy to make sure that the fleets perform well and are reliable.

By rotating their equipment sooner, private fleets can take advantage of newer technology. Newer trucks often have better fuel efficiency, enhanced safety features, and lower emissions. Regular maintenance on this equipment can extend its lifespan and reduce breakdowns. This helps ensure that vehicles are dependable, which is important in an industry focused on safety and efficiency.

Younger trucks typically come with advanced safety features that meet new regulations and expectations from consumers and businesses. Thus, private fleets invest in both their physical assets and their brand reputation by committing to higher safety standards.

As their equipment strategies evolve, private fleets are reducing average annual mileage per unit. Currently, fleets are averaging 80,400 miles per year. This position helps increase productivity and lower operational costs. Alongside competitive driver pay, this shows a thorough approach to workforce and equipment strategy that can lead to long-term success for private fleets.

| Statistic | Value |

|---|---|

| Average Driver Pay | $91,081 |

| Average Miles Driven per Truck | 80,400 miles |

| Driver Turnover Rates | 20.2% |

The decline in the share of outbound freight movements by private fleets from 75% to 70% marks a significant shift in the logistics landscape. This trend not only reflects a competitive push from for-hire carriers but also suggests that the dynamics of the freight transport market are evolving.

Private fleets, traditionally dominant, are now facing increased challenges from for-hire carriers that have capitalized on this decline. As private fleets experience reduced market share, for-hire carriers have captured approximately 19% of outbound freight movements, enabling them to enhance service quality and pricing strategies to attract shippers. This newfound competition is pushing private fleets to reassess their value propositions and operational efficiencies to retain their client base.

The implications of this decline extend to market dynamics as well. With an increased emphasis on maintaining competitive advantages, private fleets are compelled to invest in driver pay, with average compensation now reaching $91,081, and strategically reduce their annual mileage per heavy-duty truck to 80,400 miles. This multifaceted approach not only aims to improve driver retention but also optimizes their operational capabilities.

Moreover, as the logistics space becomes more crowded, both types of carriers must continuously enhance their service offerings and embrace innovative technologies to maintain relevance in a rapidly evolving market landscape. The competition triggered by this decline in market share presents an opportunity for logistics companies to innovate and elevate their logistics solutions.

The Importance of Safety in Fleet Management

Safety stands as a cornerstone in the realm of fleet management, directly influencing not only the well-being of drivers but also affecting organizational performance and efficiency. Recent statistics reveal that driver turnover has impressively decreased to 18.4%, with the average number of recorded accidents per million miles dropping to just 0.49. This advancement underscores a significant connection between safety initiatives and overall fleet effectiveness.

Investing in safety not only fosters a culture of responsibility but also enhances driver satisfaction. When drivers are assured that safety measures are prioritized, they tend to exhibit stronger loyalty to their employers, resulting in reduced turnover rates. The 18.4% turnover rate suggests that as private fleets focus on maintaining higher safety standards, job satisfaction rises, allowing drivers to enjoy more stability in their positions.

Moreover, the correlation between fewer accidents and improved efficiency cannot be overstated. With recorded accidents at only 0.49 per million miles, it is apparent that proactive safety training and adherence to safety protocols minimize risks, thereby lowering costs related to vehicle repairs, insurance, and potential litigation. This approach not only boosts profitability but also ensures that fleets can operate with reduced disruptions.

Ultimately, prioritizing safety leads to a more productive fleet. When vehicles are operating efficiently without the burden of accidents, their uptime increases, contributing positively to service delivery and enhancing customer satisfaction. Enhanced safety metrics pave the way for a safer road environment and bolster the reputation of fleet management companies, suggesting that the emphasis on safety translates into improved fleet performance and organizational success.

Conclusion

The evolving landscape of private fleets showcases significant advancements in driver pay, equipment strategies, and operational efficiencies. With average driver compensation reaching an all-time high of $91,081, it is evident that investing in skilled professionals is paramount for reducing turnover rates and enhancing driver satisfaction. Coupled with a strategic shift towards running fewer miles—now averaged at just 80,400 per heavy-duty unit—private fleets are redefining their operational paradigms. This approach not only mitigates wear and tear on vehicles but also promotes sustainability and cost-effective practices in the long run.

Moreover, the pivot towards maintaining younger equipment through faster trade cycles reinforces the commitment to performance and safety, enabling fleets to leverage the latest technological advancements and achieve greater efficiencies. The correlation between competitive driver pay, reduced mileage, and younger fleets is clear, indicating how private fleets are navigating challenges while positioning themselves for future growth.

As we consider the impact of these trends, it is crucial for fleet managers to reflect on how they can adapt their strategies in response to these shifts. By prioritizing driver welfare, optimizing their equipment choices, and rethinking operational routes, companies can enhance their overall effectiveness and ensure long-term success in a competitive landscape. Engaging in this proactive mindset will not only bolster the performance of private fleets but also contribute positively to the broader logistics industry.

Conclusion

The evolving landscape of private fleets showcases significant advancements in driver pay, equipment strategies, and operational efficiencies. With average driver compensation reaching an all-time high of $91,081, it is evident that investing in skilled professionals is paramount for reducing turnover rates and enhancing driver satisfaction. Coupled with a strategic shift towards running fewer miles—now averaged at just 80,400 per heavy-duty unit—private fleets are redefining their operational paradigms. This approach not only mitigates wear and tear on vehicles but also promotes sustainability and cost-effective practices in the long run.

Moreover, the pivot towards maintaining younger equipment through faster trade cycles reinforces the commitment to performance and safety, enabling fleets to leverage the latest technological advancements and achieve greater efficiencies. The correlation between competitive driver pay, reduced mileage, and younger fleets is clear, indicating how private fleets are navigating challenges while positioning themselves for future growth.

As we consider the impact of these trends, it is crucial for fleet managers to reflect on how they can adapt their strategies in response to these shifts. By prioritizing driver welfare, optimizing their equipment choices, and rethinking operational routes, companies can enhance their overall effectiveness and ensure long-term success in a competitive landscape. Engaging in this proactive mindset will not only bolster the performance of private fleets but also contribute positively to the broader logistics industry.

Key Takeaways:

- Average driver pay has reached $91,081, significantly impacting driver retention.

- Average miles run per heavy-duty unit have decreased to 80,400, showing a shift toward operational efficiency.

- Younger equipment and faster trade cycles enhance performance and safety.

- Adapting strategies in response to these trends is crucial for long-term success.

Insights from Industry Experts

The perspective of industry leaders like Tom Moore sheds light on the pivotal role private fleets play in controlling supply chains and enhancing safety standards. Moore emphasizes, “Private fleets are achieving a DOT recordable accident rate of 0.49 per million miles, making them three times safer than the industry average.” This highlights the critical link between safety and operational efficiency.

Additionally, Moore states, “If [the fleet] is not safe, it’s not going to be efficient, and none of the other metrics really matter that much,” reinforcing that safety is foundational to overall performance.

In addressing customer service and cost management, he notes, “Maintaining your own fleet gives you the power to manage all aspects of your transportation operations, from scheduling and route planning to driver selection.” This shows how private fleets are positioned to optimize logistics and drive efficiency sustainably.

Private Fleets Growth with Higher Driver Pay and Equipment Strategies

In the rapidly evolving landscape of logistics fleet management, private fleets are experiencing a remarkable transformation, characterized by faster growth, competitive driver pay, and innovative equipment strategies. In fact, private fleets now account for 75% of their companies’ outbound freight movements, marking a notable increase from previous years. With average annual driver compensation soaring to a record $91,081—representing a commitment to attract and retain skilled professionals—companies are recognizing that their drivers are their most valuable asset. According to Tom Moore, experts emphasize that “private fleets are capturing enhanced control over the supply chain.” Furthermore, as fleets shift towards younger equipment and adopt advanced strategies, they are increasingly reducing average annual mileage per heavy-duty unit to an all-time low of 80,400 miles. These trends not only underscore a proactive approach to transportation efficiency but also reflect the industry’s dedication to safety, with DOT recordable accident rates reported at an impressive 0.49 crashes per million miles. In this article, we will delve deeper into these trends and explore how private fleets are strategically repositioning themselves for future success.

Insights on Average Annual Mileage for Heavy-Duty Units

Recent data indicates a notable decline in the average annual mileage for heavy-duty trucks in the U.S. trucking industry. The average annual mileage per heavy-duty unit dropped to 80,400 miles in 2024, marking the lowest figure in the National Private Truck Council’s (NPTC) survey history. This downward trend is attributed to several factors, including the strategic placement of distribution centers closer to customers, which reduces the distance goods need to travel. Tom Moore, executive vice president of the NPTC, noted that this decrease can be partially explained by a higher number of distribution centers and warehouses, leading to fleets driving less.

Historically, heavy-duty trucks have experienced fluctuations in annual mileage. In 1982, Class 8 trucks averaged 50,000 miles per year, which increased to 76,500 miles by 2012. More recent statistics from the U.S. Department of Energy show that combination trucks averaged 62,229 miles annually in 2021.

For private fleet operations, the reduction in annual mileage has several implications. It can lead to lower fuel consumption and maintenance costs, as vehicles endure less wear and tear. Additionally, shorter routes and reduced time on the road can improve driver retention by allowing for more predictable schedules and increased home time. The NPTC’s report highlighted that driver turnover dropped to 18.4% in 2024, suggesting that these operational changes may positively impact driver satisfaction.

Industry experts emphasize the importance of adapting to these changes. Tom Moore stated, “Private fleets are capturing enhanced control over the supply chain,” indicating a shift towards more efficient and customer-centric operations.

In summary, the decline in average annual mileage for heavy-duty trucks reflects a broader transformation in the trucking industry, with private fleets optimizing operations to enhance transportation efficiency, reduce costs, and improve driver satisfaction.

Discuss Increase in Average Driver Pay

The rising average driver pay, now reaching a remarkable $91,081, has been pivotal in enhancing driver retention and reducing turnover rates within the trucking industry. With turnover now sitting at 18.4%, this increase in compensation has not only attracted new talent but also significantly improved job satisfaction among existing drivers. Research indicates that private fleets, often offering competitive wages and better working conditions, have achieved lower turnover rates compared to the industry average. By investing in drivers, companies are fostering a sense of loyalty and stability within their workforce, ultimately reflecting the correlation between retaining skilled drivers and competitive pay. This trend showcases the importance of truck driver trends to ensure longevity in operations.

Analyzing Equipment Strategies of Private Fleets

In the logistics sector, private fleets are adopting innovative strategies in equipment management. They focus on maintaining newer fleets and implementing faster maintenance practices. Having younger equipment helps improve logistics fleet management efficiency and lowers costs linked to older machines. Data shows that Class 8 power units are traded in after an average of just 568,000 miles. This indicates a strategy to ensure that fleets perform well and are reliable.

By rotating their equipment sooner, private fleets can take advantage of newer technology. Newer trucks often have better fuel efficiency, enhanced safety features, and lower emissions. Regular maintenance on this equipment can extend its lifespan and reduce breakdowns. This helps ensure that vehicles are dependable, which is crucial in an industry focused on safety and productivity.

Younger trucks typically come with advanced safety features that meet new regulations and expectations from consumers and businesses. Thus, private fleets effectively invest in both their physical assets and brand reputation by committing to higher safety standards.

As their equipment strategies evolve, private fleets are reducing average annual mileage per unit. Currently, fleets are averaging 80,400 miles per year. This positioning helps increase productivity and lower operational costs. Alongside competitive driver pay, this shows a thorough approach to workforce and equipment strategy that can lead to long-term success for private fleets.

Key Statistics Comparison

| Statistic | Value |

|---|---|

| Average Driver Pay | $91,081 |

| Average Miles Driven per Truck | 80,400 miles |

| Driver Turnover Rates | 20.2% |

Summarize Decrease in Private Fleet Share

The decline in the share of outbound freight movements by private fleets from 75% to 70% marks a significant shift in the logistics landscape. This trend reflects a competitive push from for-hire carriers and suggests that the dynamics of the freight transport market are evolving.

Private fleets, traditionally dominant, are now facing increased challenges from for-hire carriers that have capitalized on this decline. As private fleets experience reduced market share, for-hire carriers have captured approximately 19% of outbound freight movements, enhancing service quality and pricing strategies to attract shippers. This newfound competition is pushing private fleets to reassess their value propositions and operational efficiencies to retain their client base.

The implications of this decline extend to market dynamics as well. With an increased emphasis on maintaining competitive advantages, private fleets are compelled to invest in driver pay, with average compensation now reaching $91,081, and strategically reduce their annual mileage per heavy-duty truck to 80,400 miles. This multifaceted approach aims to improve driver retention while optimizing operational capabilities in the face of rising competition.

Moreover, as the logistics space becomes more crowded, both types of carriers must continuously enhance their service offerings and embrace innovative technologies to maintain relevance in a rapidly evolving market landscape. The competition triggered by this decline in market share presents an opportunity for logistics companies to innovate and elevate their logistics solutions.

Safety in Fleet Management

The Importance of Safety in Fleet Management

Safety stands as a cornerstone in the realm of fleet management, directly influencing not only the well-being of drivers but affecting organizational performance and efficiency. Recent statistics reveal that driver turnover has impressively decreased to 18.4%, with the average number of recorded accidents per million miles dropping to just 0.49. This advancement underscores a significant connection between safety initiatives and overall fleet effectiveness.

Investing in safety fosters a culture of responsibility that enhances driver satisfaction. Assured that safety measures are prioritized, drivers exhibit stronger loyalty to their employers, resulting in reduced turnover rates. The 18.4% turnover rate suggests that as private fleets focus on maintaining higher safety standards, job satisfaction rises, allowing drivers to enjoy more stability in their positions.

Moreover, the correlation between fewer accidents and improved efficiency cannot be overstated. With recorded accidents at only 0.49 per million miles, it is apparent that proactive safety training and adherence to safety protocols minimize risks, lowering costs related to vehicle repairs, insurance, and potential litigation. This approach not only boosts profitability but also ensures fleets operate with reduced disruptions.

Ultimately, prioritizing safety leads to a more productive fleet. When vehicles operate efficiently without the burden of accidents, their uptime increases, contributing positively to service delivery and enhancing customer satisfaction. Enhanced safety metrics pave the way for a safer road environment and bolster the reputation of fleet management companies, suggesting that emphasis on safety translates into improved fleet performance and organizational success.

Insights from Industry Experts

The perspective of industry leaders like Tom Moore sheds light on the pivotal role private fleets play in controlling supply chains and enhancing safety standards. Moore emphasizes, “Private fleets are achieving a DOT recordable accident rate of 0.49 per million miles, making them three times safer than the industry average.” This highlights the critical link between safety and operational efficiency.

Additionally, Moore states, “If [the fleet] is not safe, it’s not going to be efficient, and none of the other metrics really matter that much,” reinforcing that safety is foundational to overall performance.

In addressing customer service and cost management, he notes, “Maintaining your own fleet gives you the power to manage all aspects of your transportation operations, from scheduling and route planning to driver selection.” This shows how private fleets are positioned to optimize logistics and drive efficiency sustainably.

Conclusion

The evolving landscape of private fleets showcases significant advancements in driver pay, equipment strategies, and operational efficiencies. With average driver compensation reaching an all-time high of $91,081, it is evident that investing in skilled professionals is paramount for reducing turnover rates and enhancing driver satisfaction. Coupled with a strategic shift towards running fewer miles—now averaged at just 80,400 per heavy-duty unit—private fleets are redefining their operational paradigms. This approach not only mitigates wear and tear on vehicles but also promotes sustainability and cost-effective practices in the long run.

Moreover, the pivot towards maintaining younger equipment through faster trade cycles reinforces the commitment to performance and safety, enabling fleets to leverage the latest technological advancements and achieve greater efficiencies. The correlation between competitive driver pay, reduced mileage, and younger fleets is clear, indicating how private fleets are navigating challenges while positioning themselves for future growth.

As we consider the impact of these trends, it is crucial for fleet managers to reflect on how they can adapt their strategies in response to these shifts. By prioritizing driver welfare, optimizing their equipment choices, and rethinking operational routes, companies can enhance their overall effectiveness and ensure long-term success in a competitive landscape. Engaging in this proactive mindset will not only bolster the performance of private fleets but also contribute positively to the broader logistics industry.