In a landscape marked by economic uncertainty, the trailer market is experiencing both volatility and challenges that demand attention from fleet managers. The current hesitation among fleets to invest in new trailers, driven by a weak freight market, highlights a crucial moment for stakeholders in this industry. This hesitation is especially significant within the context of the trailer supply chain, which is feeling the effects of economic instability. In 2024, fleet management trends indicate that the need for strategic investment is critical, particularly in trailer investment strategies that emphasize sustainability and efficiency.

According to recent forecasts, trailer production orders are set to plunge from 314,000 units in 2023 to approximately 187,000 in 2025, reflecting a significant contraction in the market. Amidst rising costs due to tariffs on steel and aluminum, coupled with high cancellation rates for trailer orders, the stakes have never been higher.

Understanding the dynamics of this evolving market is critical not only for making informed purchasing decisions but also for strategic planning in an uncertain economic climate. As pressures mount, from fluctuating freight demand to potential supply chain disruptions, fleets must navigate their options carefully. This exploration of the growing demand and challenges in fleet trailer purchases will illuminate the urgent need for clarity in decision-making, thereby setting the stage for a resilient operational strategy going forward.

| Current Trailer Price | Projected Increase (16-28%) | New Projected Price (Low) | New Projected Price (High) |

|---|---|---|---|

| $25,000 | 16% | $29,000 | $32,000 |

| $30,000 | 16% | $34,800 | $38,400 |

| $35,000 | 16% | $40,600 | $44,800 |

| $40,000 | 16% | $46,400 | $51,200 |

| $50,000 | 16% | $58,000 | $64,000 |

| $60,000 | 16% | $69,600 | $76,800 |

Note: The projected increases are based on anticipated tariffs affecting steel and aluminum costs, indicating a potential significant rise in trailer prices that fleet managers must factor into future budget considerations.

Decline in Demand for New Trailers

The trailer market currently faces a decline in demand for new trailers, mainly due to issues in the freight market. Experts like Dan Moyer and Charles Dutil have observed that many fleets are hesitant to invest in new trailers as they deal with challenging economic conditions marked by low freight demand.

Dan Moyer, who closely tracks market data, noted a slight increase in trailer orders late last year. However, this increase was insufficient to offset the previous months’ significant decline, resulting in a 27% drop in net orders over the past year. This decline shows that fleets are not just being cautious but are redirecting their resources in light of uncertain profitability, often favoring investments in tractors instead of trailers.

Charles Dutil emphasizes the severity of the situation by stating, “Carriers do not just reduce their fleet size a little; they often shift from having 12 trailers to none at all.”

This drastic cut highlights the challenges fleet managers face with changing demand and economic pressures. As backlogs rise and production rates decrease, forecasts indicate a projected drop in trailer production orders to about 187,000 units in 2025, down from 314,000 in 2023.

The weak freight market worsens this decline, influencing purchasing decisions as fleets struggle to remain profitable. This makes forgoing new trailer investments a critical advantage in managing budgets amid rising costs from tariffs on key materials like steel and aluminum. Fleet managers are thus compelled to reassess their strategies thoroughly.

It is essential to align fleet strategies with current market conditions during these uncertain times. Fleets should adopt adaptable strategies that consider prevailing economic indicators and prioritize operational flexibility instead of large-scale investments. This alignment enables fleets to respond to immediate market shifts and get ready for potential demand increases as the economic landscape changes. Moyer and Dutil advocate for a vigilant and measured procurement approach that involves tracking freight trends to determine when the market might recover.

In conclusion, the fall in demand for new trailers reflects broader trends driven by a fragile freight market. By prioritizing flexibility and strategic alignment with market realities, fleets can more effectively navigate these challenges and prepare for future recovery phases.

Challenges in Trailer Maintenance and Component Sourcing

Fleets are grappling with significant challenges in trailer maintenance and sourcing components, which have intensified in light of the current economic climate. Reduced investment capabilities are hampering fleets, forcing them to operate with tighter budgets and often leading to postponed maintenance schedules. Alan Briley, VP of Maintenance at a major fleet, notes,

“We have seen challenges with some of our component manufacturers who have a part of their manufacturing offshore and we’re just trying to navigate that.”

This highlights a crucial issue: maintenance concerns are not purely operational setbacks; they are also key drivers of decreased investment in new trailer purchases.

As many fleets extend the lifecycles of their existing trailers, they face increased maintenance burdens alongside rising material costs due to tariffs on steel and aluminum. Fleet managers reported that keeping older equipment operational has led to a surge in maintenance issues like brake system failures and electrical problems, thereby straining operational efficiency and impacting overall budget considerations.

The combination of heightened maintenance needs and economic caution is contributing directly to hesitance regarding new trailer investments. As Charles Dutil aptly points out,

“Carriers do not just reduce their fleet size a little; they often shift from having 12 trailers to none at all.”

This stark reduction mirrors the sentiment among fleet operators as they consider economic stability and operational efficacy.

Key Facts Summary

- Trailer production orders are expected to drop to 187,000 units in 2025, a significant decrease from 314,000 in 2023.

- Van trailer prices may increase by 16-28% due to tariffs on key materials like steel and aluminum.

- High cancellation rates of trailer orders are attributed to economic uncertainties affecting fleet purchasing decisions.

Concluding Insights on the Future of the Trailer Market

As we look to the future of the trailer market, it is crucial to acknowledge the current challenges that fleet managers face. The decline in trailer production orders, estimated to fall to 187,000 units in 2025 from 314,000 in 2023, paints a picture of a market grappling with uncertainty. Factors such as high cancellation rates, increasing costs from tariffs on essential materials like steel and aluminum, and the overall hesitancy to invest amid weak freight demand have compounded these challenges.

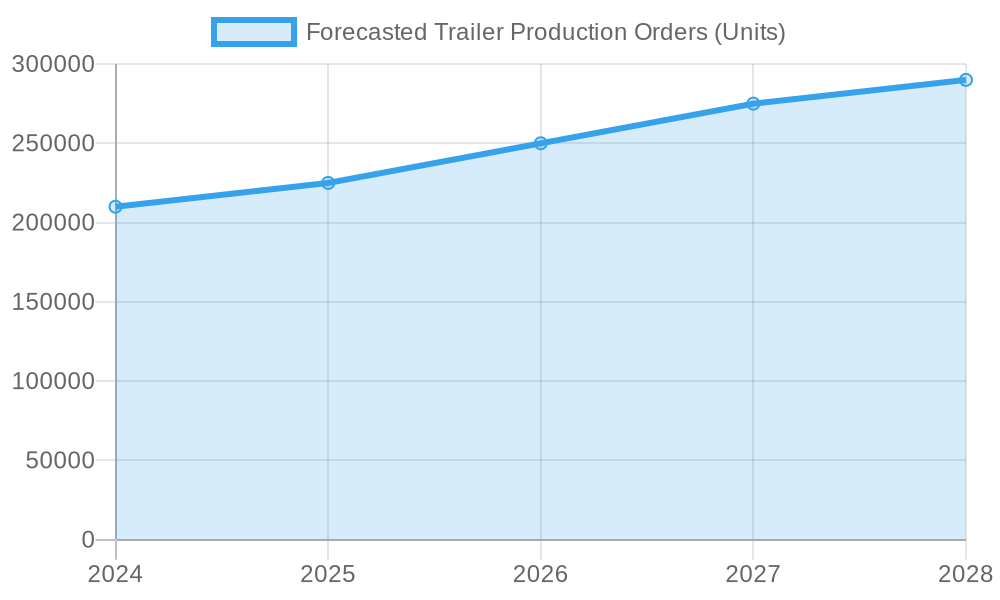

However, there is a cautiously optimistic outlook for recovery towards the latter part of 2026 and into 2027. Reports indicate that trailer production is expected to rebound, with anticipated increases to approximately 250,000 units in 2026 and further growth to 275,000 units in 2027. Furthermore, innovations and adaptations within the industry, alongside improvements in freight demand and macroeconomic conditions, may strengthen the market’s resilience.

While navigating this complex landscape, fleet managers should focus on a balanced approach: prioritizing operational efficiency, optimizing maintenance strategies, and remaining aware of market trends. By fostering a culture of adaptability and preparedness, fleets can position themselves to capitalize on opportunities as the market begins to recover. The potential for a sustained recovery by 2027 offers a glimmer of hope, signaling that while the road may be challenging, brighter days lie ahead for the trailer industry.

Sources:

- 2026 Trailer Market Analysis: Growth Opportunities – QYResearch Consulting

- Morgan Stanley Upgrades 2026 Freight Transportation Outlook – Zhitong Caijing APP

User Adoption Data for Trailers

As we explore the current landscape of trailer user adoption, several key findings emerge that highlight both trends and economic influences affecting the overall trailer market:

- Adoption Trends: The most recent data shows a 15% year-over-year decline in trailer shipments in 2023. Nevertheless, adoption rates are still markedly above pre-pandemic levels, indicating a resilient interest in trailer ownership. Notably, younger demographics, particularly those aged 18-34, are spearheading this upward trend, demonstrating a significant shift in ownership demographics within the market.

- Market Size and Growth: The global travel trailer market was valued at $25.4 billion in 2022 and is projected to grow at a CAGR of 6.8% from 2023 to 2030. This growth is fueled by increased interest in outdoor activities and the flexibility of remote work. Furthermore, the 2023 Camping and Outdoor Hospitality Report indicates that 25% of leisure travelers now use RVs or trailers for camping, up from 21% in 2022.

- Demographic Shifts: According to a survey conducted by Go RVing, 45% of new trailer buyers are under the age of 45, indicating that younger consumers are placing higher value on travel flexibility. Additionally, there is a notable increase in diversity among trailer owners, with 32% being non-white, representing the most diverse ownership cohort in RV history.

- Economic Factors: Economic conditions significantly influence trailer purchases. A 1% increase in interest rates correlates with a 3-4% decrease in new trailer purchases. Additionally, ongoing inflation and rising fuel prices add pressure on consumers considering trailer ownership.

- Long-Term Effects: The operational shifts caused by the pandemic have had lasting effects on trailer adoption. Market expansion is now estimated to be 15-20% above pre-pandemic projections. However, as economic factors exert pressure, recent adoption rates have shown signs of slowing, with consumers weighing their options carefully.

According to the 2023 RV Industry Trends Report by the RV Industry Association, over 600,000 RV shipments are projected for the year, with younger buyers representing 22% of new RV owners. This reflects a growing trend towards trailer usage among a younger audience seeking travel flexibility and recreational opportunities.