In 2023, the trucking industry finds itself at a pivotal juncture, facing a swirl of mixed signals that highlight contrasting trends between the U.S. and Canada. On one hand, U.S. for-hire truck tonnage has surged by 0.9%, reaching levels not seen since the last quarter of 2023, signaling renewed demand for freight transportation. However, this positive momentum starkly contrasts with the Canadian market, which has witnessed a staggering 14% decline in load postings in August alone compared to the previous month, and a dramatic 40% drop year-over-year.

As these economic indicators unfold, they expose underlying pressures in both markets, from rising operational costs to the evolving challenges of supply chain management. This juxtaposition paints a complex picture of the industry, compelling stakeholders to navigate the precarious balance of opportunity and adversity, and ultimately, to strategize for survival amidst shifting economic landscapes.

“The good news is that truck freight volumes had a nice end of the summer, but we do not see the market any stronger for carriers soon…” – Bob Costello

This quote reflects the cautious optimism within the industry, illustrating the tempered sentiment among stakeholders regarding current economic challenges and the uncertain future of freight demand.

User Adoption Data and Its Impact on Trucking Operations

Economic challenges are changing the trucking industry’s technology landscape. Companies are adopting new solutions to improve efficiency and address operational hurdles. Here is a summary of the latest user adoption data and its impacts on freight volumes and operations:

Technological Innovations in Adoption

- Autonomous Driving: Autonomous technologies are gaining traction. Aurora Innovation has partnered with McLeod Software to integrate its self-driving platform into management systems.

Source - AI-Driven Fleet Management: Companies like Optimal Dynamics are using AI to optimize logistics. They report potential weekly revenue gains of up to 24% through better load matching.

Source - Electrification: Companies like PepsiCo are adopting electric trucks for short to mid-range deliveries. This aligns with sustainability goals and reduces long-term costs.

Source

Impacts on Freight Volumes and Operations

- The American Trucking Associations (ATA) predicts modest growth of 1.6% in truck volumes for 2025. This translates to nearly 14 billion tons of freight by 2035.

Source - Despite this, companies are facing a labor shortage. Over 80,000 drivers are needed, a number that will grow by 2030. Legislative efforts are underway to attract drivers, but immediate capacity challenges persist.

Source - Regulatory pressures are leading to investments in zero-emission vehicles. However, infrastructure and cost challenges hinder widespread adoption.

Source

In summary, the trucking industry’s future will be shaped by emerging technologies and ongoing economic challenges. Stakeholders must navigate these changes to seize new opportunities while minimizing risks.

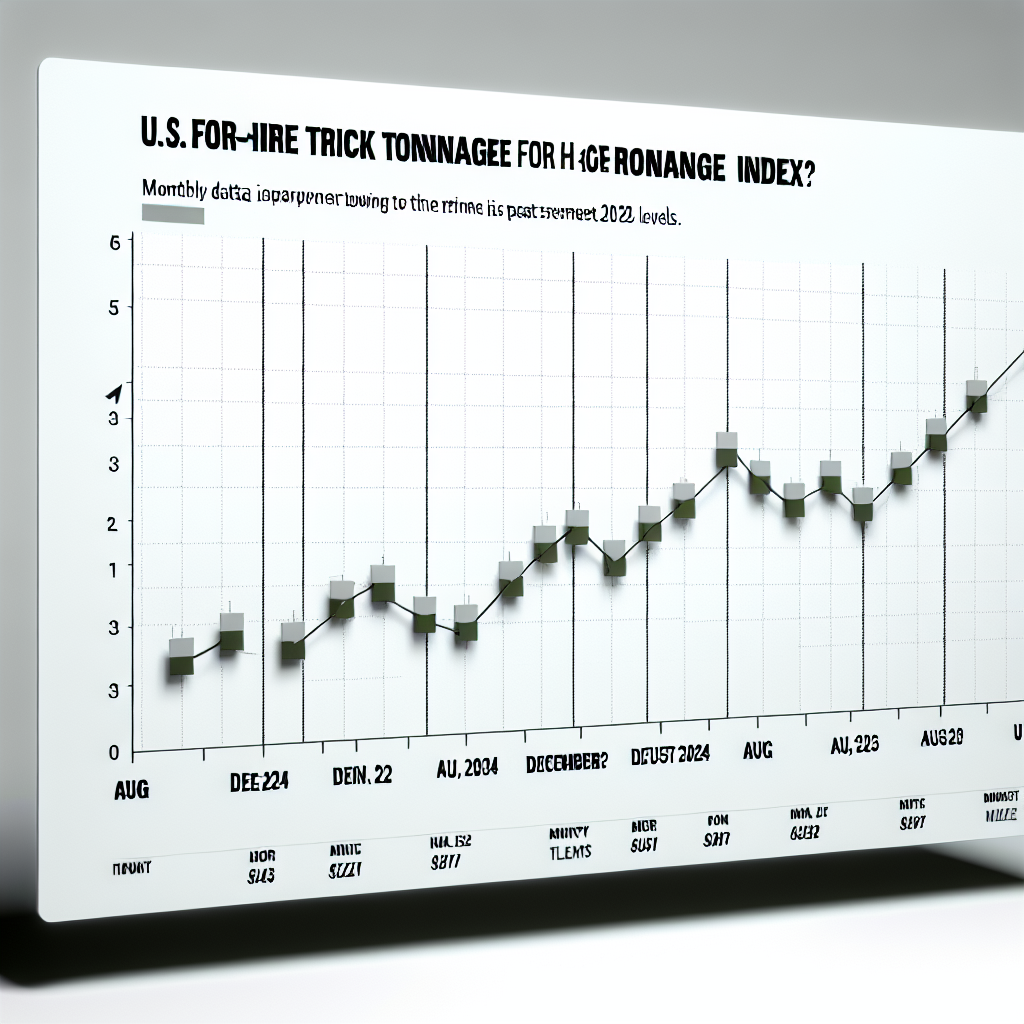

This chart illustrates the trend of U.S. for-hire truck tonnage from December 2024 to August 2025, showcasing the highest levels since December 2023. The index reflects fluctuations in freight volumes, indicating various economic pressures and responses in the trucking industry.

U.S. vs. Canada Market Analysis for August 2025

In August 2025, the contrasting dynamics of the U.S. and Canadian trucking markets became increasingly evident. The U.S. market experienced an uptick in for-hire truck tonnage, with figures rising by 0.9%. This growth represents the highest levels recorded since December 2023, driven by improving freight volume as shippers adapt to new tariff policies. However, the backdrop of mounting operational challenges complicates this positive trend.

U.S. Market Insights

A surge in freight volume coincided with changes in tariff regulations. Following the suspension of the ‘de minimis’ exemption, which resulted in tariffs on previously duty-free shipments, the U.S. trucking industry recorded $30 billion in tariff revenue in August alone. This financial impact has escalated transportation costs, forcing shippers to reevaluate their logistics and shipping strategies. As Bob Costello noted, “The good news is that truck freight volumes had a nice end of the summer,” but cautioned that it may not lead to a stronger market for carriers in the near term.

Operational challenges persist, as carriers reported a significant increase in driver recruitment and retention issues—70% of them identified these as top concerns, alongside rising insurance costs, which affect operational margins. With growing competition and a shrinking driver pool, many carriers have adopted more conservative approaches in capital investment, with only 21% planning to invest in new equipment amidst uncertainty.

Canadian Spot Market Dynamics

Conversely, Canada’s trucking spot market faced a more severe downturn. Load postings dropped by 14% from July and plunged by 40% year-on-year, significantly affecting both domestic and cross-border shipments. The truck-to-load ratio soared to 4.20—10% higher from the previous month—indicating a soft market where competition for available loads intensifies.

Economic indicators are further exacerbated by trade tensions: tariffs are weighing heavily on freight demand, as highlighted by ACT Research, which noted that adverse tariff effects continue to unfold. The Canadian economy also appeared fragile due to manufacturing sector contractions and rising youth unemployment, contributing to a loss of nearly 41,000 jobs in July. This downturn in hiring compounds the operational struggles faced by carriers, as reduced availability of loads translates into pressure on rates and potentially dwindling profits.

Operational Implications for Carriers and Shippers

For carriers operating in the U.S., the mixed recovery in freight volumes could allow for higher demand, but escalating costs related to tariffs and driver shortages likely limit profitability. Sustainability measures may need to be balanced with immediate economic pressures. Shippers, facing spiraling transportation costs—identified as the main concern by 74% of surveyed companies—must navigate these operational challenges to maintain efficient supply chains.

In Canada, the softness in the spot market may compel shippers to be more proactive in securing freight capacity, particularly in anticipation of market rebounds should capacity exit continue. Although concerns about securing reliable capacity exist, a survey indicated that 85% of carriers and 83% of brokers believe overall demand may stabilize or increase in the coming months.

In summary, August 2025 delivered mixed signals across both the U.S. and Canadian trucking markets, with the U.S. reflecting a cautious optimism amid operational challenges, while Canada grappled with potent downward pressures stemming from economic contraction and trade disputes. Stakeholders on both sides of the border are urged to remain agile in navigating this complex landscape, balancing opportunities against operational risks.

This image showcases freight trucks in a transportation setting, illustrating their scale and importance in the economy. The visual provides a break in the text, emphasizing the crucial role trucks play in logistics and freight movement.

| Vendor | Recent Reports | Key Insights |

|---|---|---|

| Loadlink Technologies | “Economic Outlook for 2025” | Emphasizes the significance of optimizing load matching to improve spot market dynamics. |

| American Trucking Associations | “ATA Freight Transportation Forecast for 2025” | Projects 1.6% growth in truck volumes, highlighting adjustments needed to tackle driver shortages. |

| ACT Research | “Impact of Tariffs on Freight Demand” | Warns that adverse effects of tariffs will persist, leading to fluctuations in freight demand and rates. |

Future Projections for the Trucking Industry

As we look ahead, the trucking industry finds itself at a critical crossroads, influenced by key changes in Class 8 tractor production and the trucking conditions index (TCI). These factors not only have significant implications for freight volumes but also pose challenges to market stability.

Class 8 Tractor Production Trends

Forecasts indicate a troubling decline in the production of Class 8 tractors. According to Volvo Group, the North American truck market is expected to remain weak through 2026 due to a prolonged slump in freight activity exacerbated by recent U.S. tariffs. This has led Volvo to reduce its 2025 heavy truck delivery estimates to 265,000 units, a decrease of 10,000 from earlier projections. Similarly, ACT Research notes that while vocational Class 8 demand has seen some steadiness due to infrastructure projects, various operational challenges are dampening new order momentum, including slowing construction starts and rising equipment costs. Elevated inventories from previous production runs are particularly worrying for manufacturers, as they are forced to recalibrate their production schedules to avoid oversaturating the market.

Changes in the Trucking Conditions Index (TCI)

The TCI, which provides insights into market dynamics through factors like freight rates and fuel prices, has exhibited notable fluctuations. In June 2025, the index plummeted to -1.83, the lowest for the year, primarily driven by declines in freight rates along with rising fuel costs. Looking forward, projections suggest that TCI readings will generally remain negative through the early parts of 2025. Although there are expectations for a more favorable market environment for carriers, uncertainties related to freight volumes and fluctuating fuel prices continue to challenge stability.

Expected Impact on Freight Volumes and Market Stability

Despite these challenges, the American Trucking Association (ATA) forecasts a 1.6% growth in truck volumes for 2025, projecting nearly 14 billion tons of freight by 2035. However, the long-term outlook is tempered by the ongoing trade tensions and tariff policies. These elements have introduced volatility in freight demand, causing stakeholders to remain cautious as they navigate the complexities of the economic landscape.

To summarize, while potential growth in freight volumes is projected, the trucking industry still faces considerable challenges stemming from drops in Class 8 tractor production and negative trends in the trucking conditions index. The interplay of external factors, such as trade policies and market conditions, will be pivotal in determining the overall stability and health of the industry in the coming years. Stakeholders must remain agile and adaptable in this shifting environment to harness opportunities while mitigating risks.

In conclusion, the economic landscape of trucking in 2023 presents a complex array of challenges and opportunities for carriers and shippers alike. With U.S. truck tonnage showing a cautious recovery and Canadian spot market conditions remaining precarious, the outlook demands careful navigation. As the industry grapples with diverse factors—from fluctuating freight volumes to rising operational costs—stakeholders must adopt a proactive approach. Emphasizing the importance of staying informed about market fluctuations and technological advancements is paramount. Embracing innovative solutions while preparing for potential disruptions can empower players in the trucking industry to better manage risks and leverage emerging trends. Ultimately, a balanced strategy addressing both immediate concerns and long-term growth prospects will be crucial for navigating this ever-evolving landscape.

In conclusion, the economic landscape of trucking in 2023 presents a complex array of challenges and opportunities for carriers and shippers alike. With U.S. truck tonnage showing a cautious recovery and Canadian spot market conditions remaining precarious, the outlook demands careful navigation. As the industry grapples with diverse factors—from fluctuating freight volumes to rising operational costs and supply chain challenges—stakeholders must adopt a proactive approach. Emphasizing the importance of staying informed about market fluctuations and technological advancements is paramount. Embracing innovative solutions while preparing for potential disruptions can empower players in the trucking industry to better manage risks and leverage emerging trends. Ultimately, a balanced strategy addressing both immediate concerns and long-term growth prospects, including the trucking industry outlook, will be crucial for navigating this ever-evolving landscape.

Key Facts about Economic Trends in Trucking

- U.S. Tonnage Increase: For-hire truck tonnage in the U.S. rose by 0.9% in August, marking the highest levels since December 2023.

- Canadian Spot Market Decline: The Canadian spot market experienced a 14% decrease in load postings from July to August and a staggering 40% decrease year-over-year.

- Truck-to-Load Ratio: The truck-to-load ratio reached 4.20 in August, indicating a competitive market with more trucks than available loads.

- Class 8 Tractor Production: Production of Class 8 tractors is predicted to decline by over 30% in the latter half of 2025 compared to the first half.

- Improvement in Trucking Conditions Index: The Trucking Conditions Index saw an improvement to -1.03 in July, reflecting some recovery in market conditions.

- Expert Perspectives: Expert opinions underscore a cautious outlook, with Bob Costello noting growth in freight volumes but cautioning against expecting a stronger market soon, while Tim Denoyer predicts that the negative impacts of tariffs are yet to fully materialize.

The chart and the table both represent unique aspects of the trucking industry’s economic trends.

- Chart on U.S. For-Hire Truck Tonnage: This chart illustrates the trend of U.S. for-hire truck tonnage, showcasing significant monthly changes in freight volumes, providing insights into overall industry performance. As of August 2025, the tonnage index reached 115.3, indicating a recovery, despite challenges.

- Vendor Comparison Table: This table contrasts service providers, offering detailed insights based on recent reports and key performance indicators from each vendor, such as load matching efficiencies and projected freight growth.

The two elements serve distinct functions and do not duplicate visual information, ensuring a comprehensive understanding of both industry dynamics and vendor competitiveness.